Everything you need to know about the contingent charging ban

In recent years, there has been a lot of controversy surrounding the Defined Benefit transfer market.

To improve the quality of financial advice that clients receive, and to improve consumer confidence, the Financial Conduct Authority has implemented a ban on contingent charging for pension transfers.

Contingent charging can lead to clients getting advice that is not in their best interests

As of 1st October 2020, the Financial Conduct Authority (FCA) has banned contingent charging on Defined Benefit transfers in all but a few scenarios.

The issue arises on the transfer of Defined Benefit (DB) pensions to a Defined Contribution (DC) pension. A DB pension, sometimes known as a Final Salary pension, pays a client an annual income when they retire. This type of pension can be useful for people who want financial security.

Under a DC arrangement, a client is free to access the full amount of their pension fund, and take it as lump sums, drawdown, or a combination. The Pensions Regulator (TPR) and the FCA believe that it will typically be in the best interests of members to keep their DB pension. The decision to transfer should be based on a number of factors including the client’s age, financial situation, health etc.

Under the ‘contingent charging’ model, a financial adviser can only charge a client if the transfer of a pension goes ahead. While this can mean that the client receives free advice if they choose not to transfer, their adviser may try to sway them to do so, even if it is not in their best interests.

It is vital, therefore, to find a trusted pension transfer specialist to give advice on the best outcome for a client.

Prior to the ban, unscrupulous financial advisers had a conflict of interest when giving clients advice regarding a transfer from a Defined Benefit pension to a Defined Contribution pension.

The decision to ban contingent charging has been under consideration since March 2018, when the FCA first discussed ways to improve the quality of pension transfer advice. By the summer of 2019, they concluded that contingent charging was “an obvious conflict of interest” for financial advisers.

Almost 200 firms have left the pension transfer market since the FCA confirmed the ban

As of 1st October 2020, the FCA has banned contingent charging in most circumstances, meaning that clients will now have to pay for financial advice regarding whether to transfer their DB pension.

However, they may be eligible for an exemption if they have certain identifiable circumstances, such as suffering from a serious illness.

The changing of the charging model has prompted fears about less well-off people being unable to access financial advice.

To remedy this, the FCA are also introducing new proposals for ‘Abridged Advice’ to help customers access advice at a more affordable cost. Many companies are charging between £500 and £1,500 plus VAT for the ‘Abridged Advice’ service.

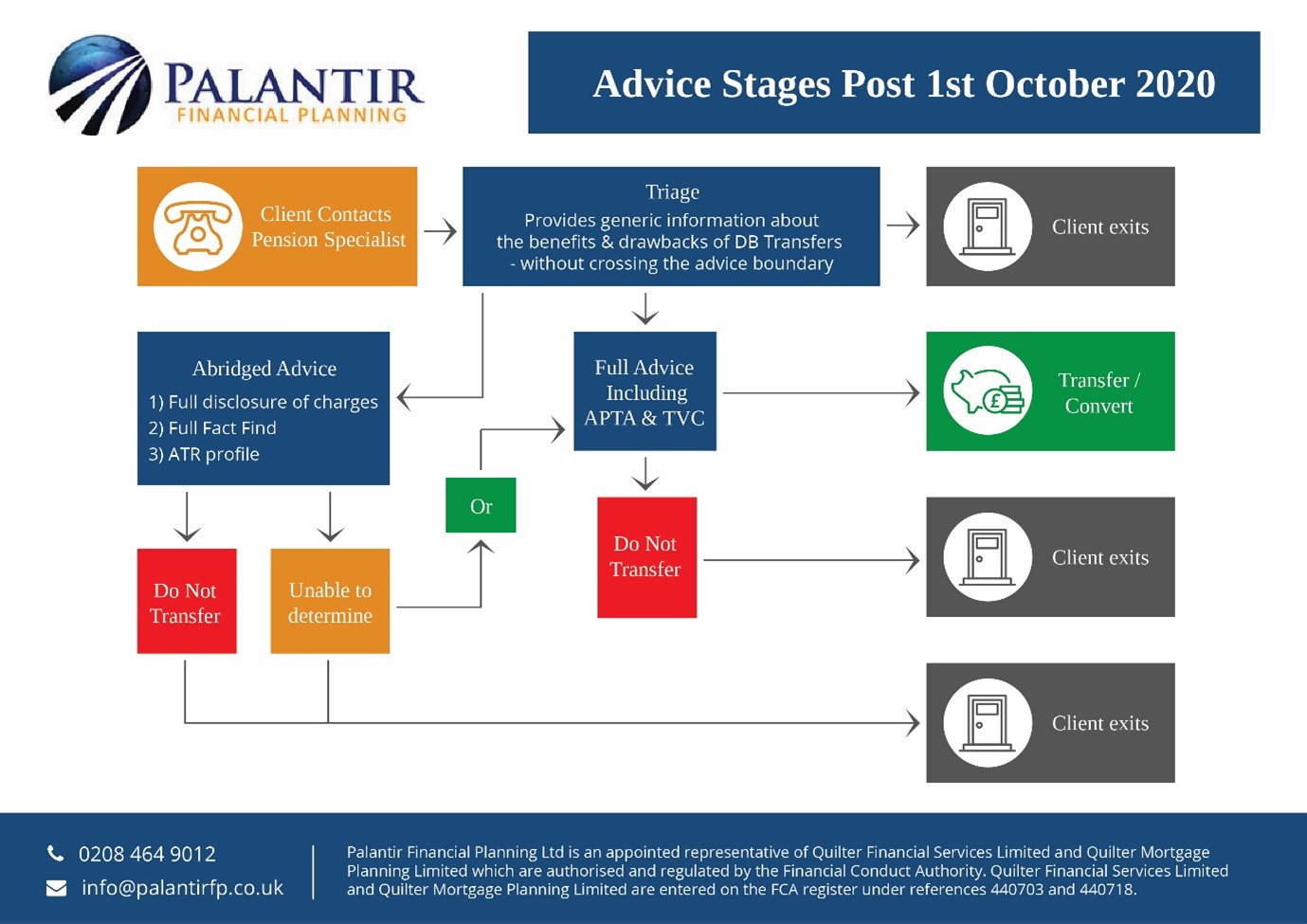

Download this flowchart as a PDF here.

Triage provides generic information about the benefits and drawbacks of DB transfer without crossing the advice boundary.

Abridged Advice requires full disclosure documentation to be given to the client including the fee charging structure. The pension specialist will carry out a full fact find, and ‘attitude to risk’ questionnaire with the client. The adviser will either:

- Make a recommendation NOT to transfer

- Say they are ‘unable to determine’ at which time the client has the option to exit the process or move to full advice.

Full Advice Is separate and distinct from ‘Abridged Advice’. Full advice includes a full analysis of the scheme/CETV/APTA/TVC. The client will receive a comprehensive suitability report and the adviser will either recommend:

- A transfer

- Do not transfer.

Both options are usually chargeable.

Many advisers have left the DB transfer market as a result of this change

Another result of the proposed ban is that many financial advisers have left the DB pension transfer market. According to Money Marketing, a total of 193 advice firms have left the market since the FCA’s contingent charging ban was confirmed in June.

The FT reports that, three years ago there were more than 3,000 specialist transfer advisers operating in the UK market but this number has shrunk to around 1,000 today.

It’s not just the contingent charging ban that has been to blame for advisers leaving this market. Many advisers have seen steep rises in the cost of Professional Indemnity (PI) cover, which provides insurance against compensation claims from customers for poor advice.

In addition, pension transfers typically require a significant amount of effort. Giving advice can be a time-consuming process, and advisers need to specialise in this area of work in order to offer the very best advice.

Get in touch

As fewer and fewer firms continue to offer DB transfer advice, finding an expert is evermore crucial.

Unlike many other companies, at Palantir Financial Planning Ltd we have decided not to charge for Abridged Advice at this present time. This means clients can still receive some form of advice concerning their DB pension without being charged.

Unlike many other companies, at Palantir Financial Planning Ltd we have decided not to charge for Abridged Advice at this present time. This means clients can still receive some form of advice concerning their DB pension without being charged.

We are Pension Transfer Specialists who primarily focus on advising clients who require advice on their DB pensions. We hold the Pension Transfer Gold Standard, which underlines our commitment to strict standards when it comes to helping each client understand and obtain appropriate financial advice.

Eamonn Prendergast, who is a Pension Transfer Specialist, has also been shortlisted as a finalist for two prestigious financial awards.

The first is in the Adviser of the Year category at the 2020 Professional Adviser awards while the second is in the Retirement and Later Life Specialist of the Year category at the 2020 Personal Finance Society Awards.

We work closely with other financial advisers to help them and their client receive the best possible advice. Read reviews from advisers and clients who have worked with us in the past.

We work closely with other financial advisers to help them and their client receive the best possible advice. Read reviews from advisers and clients who have worked with us in the past.

If we can assist you or you have clients who you think could benefit from discussion with us, please get in touch. Email info@palantirfp.co.uk or call 0208 464 9012.