Pensions

The value of pensions and the income they produce can fall as well as rise. You may get back less than you invested.

Tax treatment varies according to individual circumstances and is subject to change.

Please note that whilst every effort is made to ensure that the information contained within this explanation is correct, these notes are by necessity brief and of a generalised nature. We would provide specific personalised advice prior to finalising any arrangement.

At the Palantir Financial Planning Ltd, we believe all existing and deferred members of a pension scheme should have an annual review of their pensions and investments in order to ascertain how they are performing and if any improvements can be made.

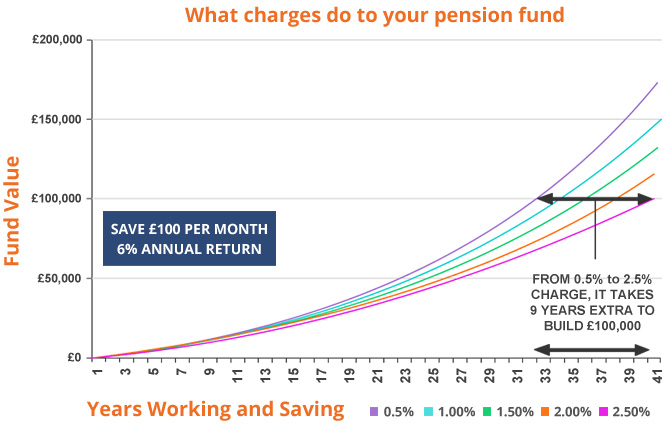

It is estimated that these hidden charges reduce the fund value by a third over the pension lifetime.

Transferring out of a Final Salary scheme is unlikely to be in the best interests of most people.

The value of pensions can fall as well as rise. You may get back less than you invested.

At Palantir Financial Planning Ltd we can undertake a review of all your pensions. This is commonly known as a Pension Health Check which includes gathering information from your scheme providers which will consist of a full investigation into any hidden costs, performance of the pension and the funding position of the scheme. After a full thematic review we will highlight areas of improvement and facilitate any alterations that you may wish to make. We attempt to make the process as simple as possible for our clients to understand. We do this by using plain English and limiting pension jargon terminology to communicate our findings in a clear and concise manner.

Step 1 Initial contact

Step 2 Goal and Objectives.

Step 3 Recommendations

Step 4 Ongoing Reviews

Palantir Financial Planning Ltd can start working for you once we have received a completed Letter of Authority. We can then liaise with all the scheme providers and carry out a full Pension Health Check identifying any hidden costs and evaluate the performance of your pension(s). We have the latest client relationship management systems and computer software which is an integral part of financial planning. We believe that face to face contact and the spoken word is just as important. Our clients are not a number on a spreadsheet. We want to understand our clients in order to give the best possible advice and personal service.

At Palantir Financial Planning Ltd we work back from the client to understand your goals and objectives both in pre and post retirement and how this can be achieved. This part of the process of getting to know you is vital before any recommendations can be made. We pride ourselves on the personal touch where we can build an open and honest relationship by phone, email and face to face meetings.

Recommendations can only be made once a full analysis and research of your current scheme has been undertaken, comparing the alternatives that exist in the market taking into account your attitude to risk and investment time horizon. Once you are happy with the recommendations we can implement any changes to enhance your retirement plans.

Ongoing reviews are vital to ensure that you are staying on track to achieve your goals and objectives. As your life changes so should your plans. Changes in legislation, employment, inheritance, and performance of the fund all need to be monitored on a regular basis.

We offer a free no obligation initial consultation in which you can have an open and honest conversation with an FCA Registered company to determine if we can assist with your future financial plans.

“A budget is telling your money where to go instead of wondering where it went”